[ad_1]

Bitcoin has damaged again above the $27,000 degree through the previous day, but when on-chain knowledge is to go by, this surge could not final for lengthy.

Bitcoin Buyers Are Taking Earnings At Highest Fee In 3 Months

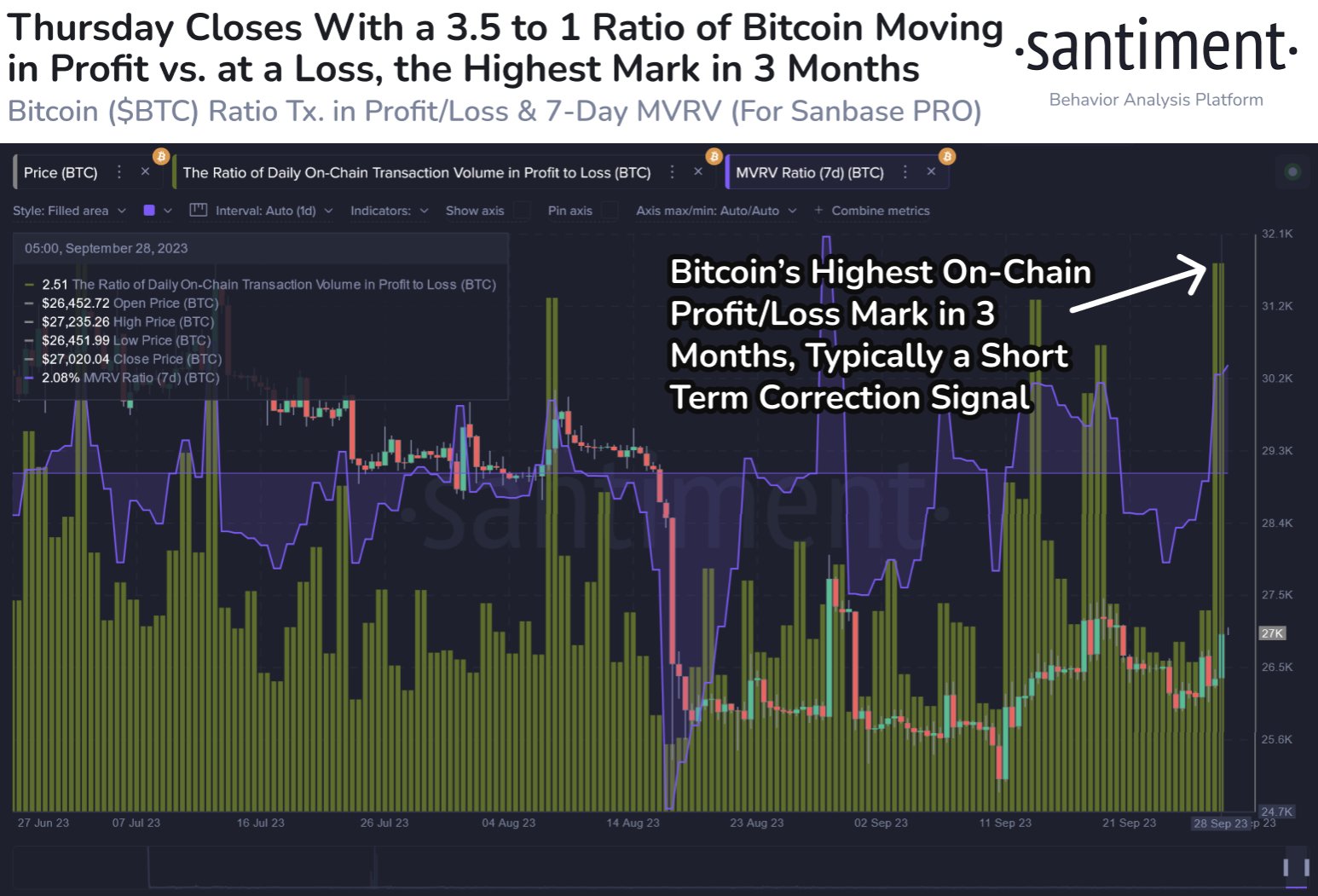

In keeping with knowledge from the on-chain analytics agency Santiment, there’s a likelihood {that a} short-term correction may occur for the cryptocurrency. The related metric right here is the “ratio of day by day on-chain transaction quantity in revenue to loss,” which, as its title suggests, tells us about how the profit-taking quantity compares towards the loss-taking quantity on the Bitcoin community proper now.

This indicator works by going by way of the transaction historical past of every coin being offered/transferred on the blockchain to see what worth it was moved at earlier than. If this earlier promoting worth for any coin was lower than the present spot worth, then that coin is being offered at a revenue proper now.

The sale of all such tokens would contribute towards the Bitcoin profit-taking quantity, whereas cash of the alternative kind would add in the direction of the loss-taking quantity.

Now, here’s a chart that exhibits the development on this BTC metric over the previous few months:

The worth of the metric appears to have been fairly excessive in current days | Supply: Santiment on X

As displayed within the above graph, this Bitcoin indicator has noticed a big spike because the cryptocurrency’s worth itself has seen a surge past the $27,000 mark and has reached a price of two.51.

When the metric has a price larger than zero, it signifies that the profit-taking quantity is greater than the loss-taking quantity. However, values underneath this threshold counsel the dominance of loss-taking.

On the present worth of two.51, the profit-taking quantity outweighs the loss-taking one by 3.51 to 1. This disparity between these two volumes is the best it has been since round three months in the past.

Traditionally, intense profit-taking has normally resulted in not less than a short-term prime for Bitcoin, so it’s attainable that the present values of the metric would additionally lead to a correction for the worth.

Within the chart, Santiment has additionally hooked up the info for the “Market Worth to Realized Worth (MVRV) ratio,” which retains monitor of the distinction between the Bitcoin market cap and realized cap.

The latter of those is principally a measure of the full quantity of capital that the traders as an entire have put into the cryptocurrency, so this metric tells us how the worth that the holders are carrying at the moment compares with their whole funding.

From the graph, it’s seen that the 7-day Bitcoin MVRV ratio has turned notably constructive with this rise, which means that the traders are carrying income in the mean time.

The analytics agency notes that this metric going again beneath zero can be best for the subsequent leg up, because the holders being in loss would result in an exhaustion of the profit-sellers.

BTC Worth

To this point, regardless of the aggressive profit-taking occurring available in the market, Bitcoin has managed to carry above the $27,000 mark.

BTC has noticed a powerful surge up to now day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link